California Tax Info: File, Pay, & Access - [FTB Resources]

Are you ready to navigate the complexities of California's tax landscape? Understanding the California Franchise Tax Board (FTB) is not just a matter of compliance; it's a pathway to financial clarity and informed decision-making, especially in the current economic climate.

The FTB offers a range of online services designed to streamline the tax filing process. These services include the ability to file returns, make payments, and check the status of your refund. You can also log in to your MyFTB account for personalized access to your tax information and account management tools. For those seeking information on specific topics or online services, the FTB website provides direct links to popular resources. The state government's commitment to accessibility is evident in the design and maintenance of the FTB website, which has been certified to be accessible as of July 1, 2023. This certification ensures that individuals with disabilities can access and use the website effectively, aligning with California Government Code sections 7405 and 11135. Furthermore, the website is part of the state's official online presence, as reflected by the A.ca.gov domain.

| Agency | Franchise Tax Board (FTB) |

| Last Updated | January 15, 2025 |

| Mission | To assist taxpayers in filing tax returns accurately, on time, and ensuring that taxes are paid. |

| Partner Agencies | Board of Equalization, California Department of Tax and Fee Administration, Employment Development Department, Internal Revenue Service. |

| Accessibility | Website certified accessible as of July 1, 2023, in accordance with California Government Code sections 7405 and 11135. |

| Online Services | Filing returns, making payments, checking refunds, accessing MyFTB account. |

| Tax Forms | Forms 540 and 540NR are commonly used for California state income tax filing. The 540 2EZ tax calculator is not supported. |

| Taxable Income Input | For accurate tax calculations, enter California taxable income from line 19 of Form 540 or Form 540NR. |

| Website Address for Reference | Franchise Tax Board - California |

The FTB plays a crucial role in the state's financial ecosystem. As a key agency, the FTB partners with other governmental bodies to ensure that the state's financial operations run smoothly and efficiently. The website and its online portals provide essential services for taxpayers, including the ability to file returns, make payments, and track refunds. You can access your account by logging in to your MyFTB account.

The FTB website has been certified as accessible as of July 1, 2023. This certification underscores the FTB's dedication to inclusivity and its commitment to ensuring that all Californians can access and use its online resources. The certification of the website adheres to California Government Code sections 7405 and 11135. The website also provides a wealth of information, and online services.

To access specific services, users are often prompted to enter their social security number and last name. Its essential that this information matches the records on file to gain access to the service. When using the tax calculator, its important to note that California taxable income is a required field, and the correct line (line 19 of Form 540 or Form 540NR) must be used. The tax calculator is not designed to work with Form 540 2EZ, and users are directed to the appropriate tax tables in the tax calculator, tables, and rates section of the website. Other areas provide forms to use, such as correspondence and payment forms.

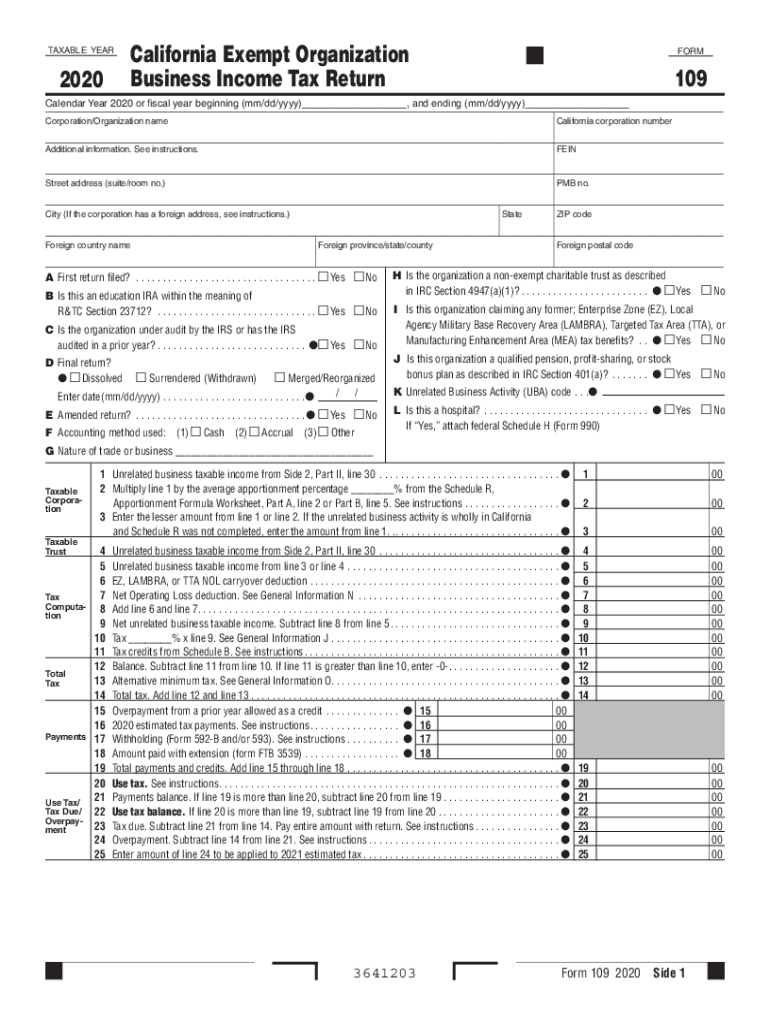

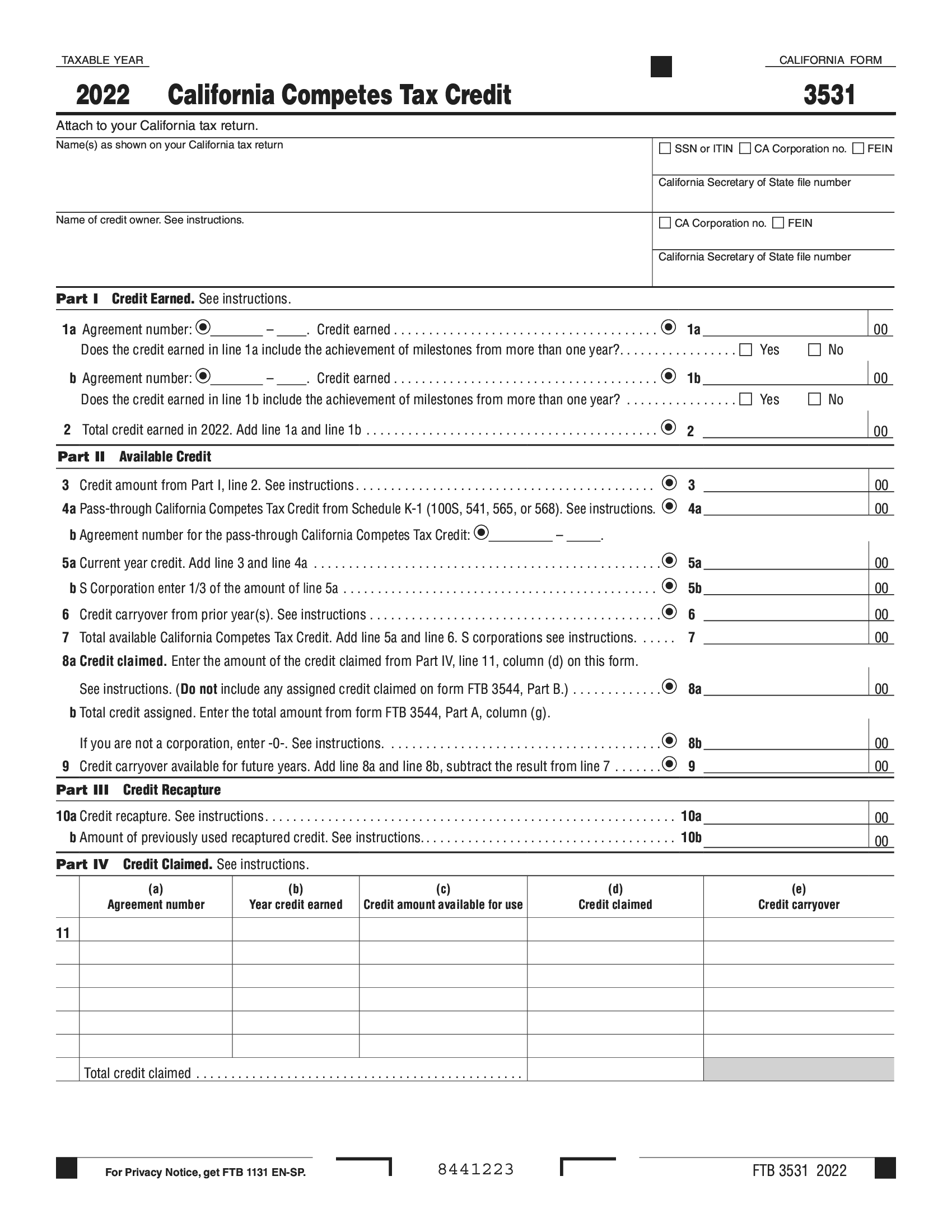

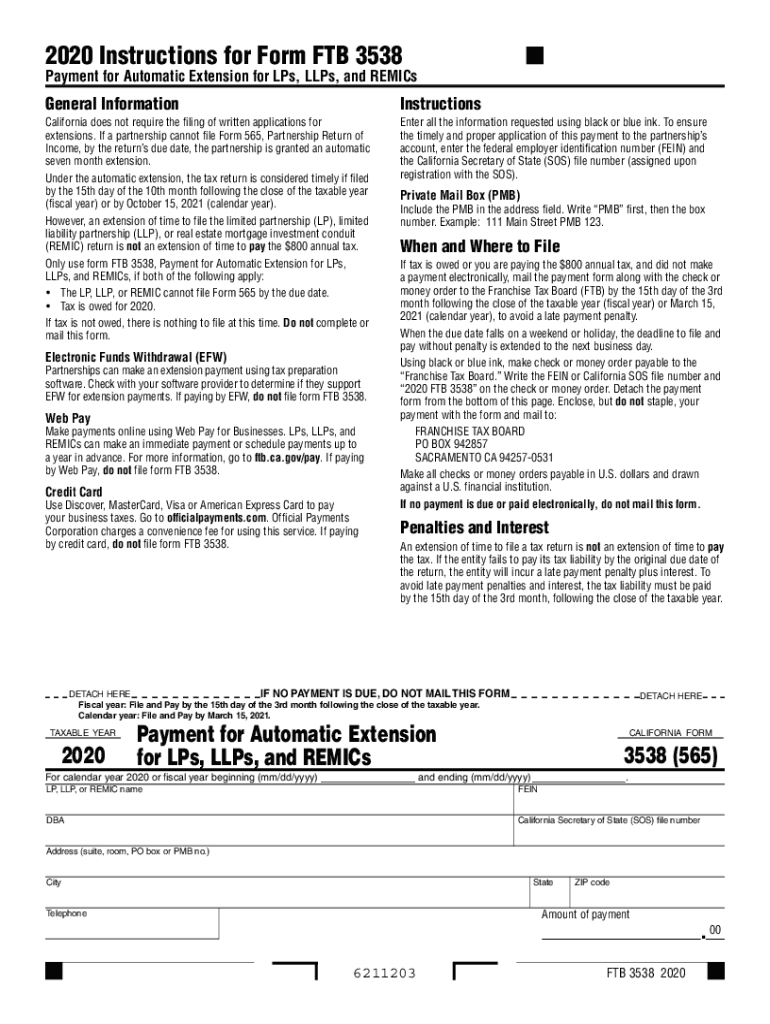

For instance, when dealing with forms, individuals can choose between forms submitted with payment, those submitted without payment, or other correspondence. These forms are categorized by codes, such as 100, 100s, 100w, 100x, 109, 565, 568 etc.

One of the most significant aspects of the FTBs operations is its commitment to accessibility. The FTBs website has been meticulously designed and maintained to ensure that it is accessible to all users, including those with disabilities. This commitment is formalized through certifications and compliance with the California Government Code sections 7405, 11135, and various regulations which are integral to ensuring digital inclusion. This means that the website is structured in a way that allows users with visual, auditory, motor, or cognitive impairments to easily navigate and utilize the resources available. The website's structure has been affirmed in writing and on record for July 1, 2023.

For those using the tax calculator, the process involves entering the California taxable income from line 19 of either Form 540 or Form 540NR. The calculator is designed to provide accurate tax calculations. However, it is important to note that the calculator does not accommodate Form 540 2EZ. If you need to calculate tax based on Form 540 2EZ, you should consult the 540 2EZ tax tables available on the tax calculator, tables, and rates page. Furthermore, for tax calculations, users need to read across columns, labeled by filing status, until they reach their corresponding taxable income and filing status to find the applicable tax.

When using these resources, its imperative to accurately provide the required information. If you are attempting to use online services, be prepared to enter your social security number and last name, and the system will only grant access if the combination matches the records in their system. All of this data is encrypted, and kept private and confidential. This is just one of the ways that the Franchise Tax Board protects the information of its users. The Board also employs a team of specialists whose primary focus is to make sure that data is secure.

The FTB's mission revolves around helping taxpayers file tax returns timely and accurately, ensuring the payment of taxes owed to the state. They do so by providing accessible online services and resources that are easily accessible, that conform to all of the current regulations. The FTB, with its partner agencies, strives to make tax processes more transparent and accessible to everyone in the state.

The FTB also collaborates with various partner agencies, including the Board of Equalization, the California Department of Tax and Fee Administration, the Employment Development Department, and the Internal Revenue Service. This collaboration helps foster better services for taxpayers through information sharing and efficient administration of programs. These agencies work to promote seamless interactions.

The information presented here is for informational purposes only and should not be considered as professional financial or tax advice. Always consult with a qualified tax professional for personalized guidance.