State Farm Insurance: Payments, Grace Periods & More!

Ever wondered how much leeway you have when it comes to paying your State Farm insurance bill? Understanding the grace period for your State Farm policy is crucial to avoid coverage lapses and potential financial penalties.

Navigating the world of insurance can sometimes feel like deciphering a complex code. State Farm, like most insurance providers, offers a grace period, but what exactly does this entail? It's essential to understand the nuances of these policies to ensure continuous coverage and avoid any unexpected financial repercussions.

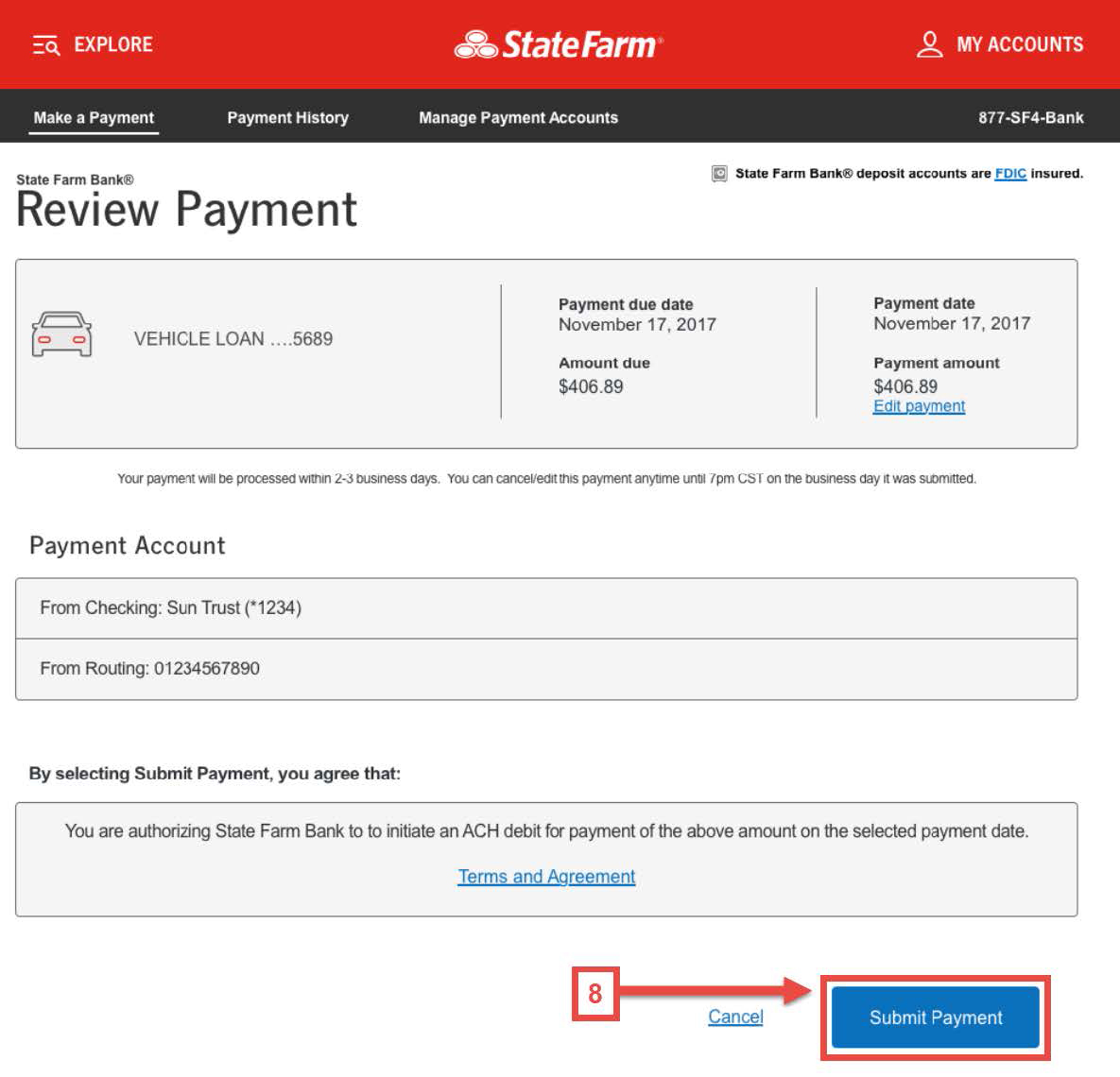

Whether you're looking to access your bills, explore online payment options, or set up automatic payments, State Farm provides various resources to assist you. The information you need regarding your State Farm insurance can be readily found. The online portal and FAQs section contain many of the answers you need, allowing you to take control of your insurance management. The billing notice itself may contain specific details about returned payment fees or late payment penalties. Furthermore, State Farm offers the convenience of storing your bills online in your document center.

Is that receipt you get the same thing as proof of insurance? Do remember that the grace period provided by State Farm offers a crucial buffer. If you miss your payment deadline, the policy may be canceled. However, with a grace period, you have a specific window to bring your payments up to date without immediate cancellation. Also, remember that if you have autopay set up but there are insufficient funds to cover the payment, State Farm provides an extension. This can be up to 15 days, offering flexibility in managing your finances.

Many insurance companies, including State Farm, offer this flexibility. The grace period for car insurance late payments is generally around 10 days. During this time, policyholders can submit overdue payments without immediate repercussions like policy cancellation or late fees. However, its always wise to check the specifics of your policy, as the exact duration can vary depending on the type of insurance and the state you reside in. For State Farm, you're generally afforded about 10 days to make your payment after the due date before incurring late fees. So even if you're late, there's still a chance to make your payment without a penalty. Also, paying on time is paramount, but don't despair if you miss the deadline by a few days.

Late payments can trigger a series of adverse effects. This is why it is crucial to pay your bills on time, which can have a positive impact on your credit report. Bills that are over 30 days late will appear on your credit report, and payment history is a huge factor that can influence your credit score. Remember that late payments can remain on your report for up to seven years. Besides these factors, State Farm may also charge late fees or interest on the overdue payment. This could significantly impact your finances, particularly if you tend to miss payments frequently.

If you've been a reliable payer in the past, State Farm might show some flexibility when it comes to the grace period. However, the type of policy and coverage you have can also affect this. Keep in mind that State Farm is implementing late fees soon. It's important to stay informed about these changes and proactively manage your payments to avoid any financial surprises.

To fully understand the details, it is important to review your policy documents or contact State Farm directly. Understanding these rules will help you avoid any difficulties with your insurance coverage.

Now, let's delve deeper into the nuts and bolts of the State Farm grace period. For auto insurance policies with State Farm, the grace period is commonly around 10 days. This gives you some leeway after the due date posted on your bill to settle your dues.

However, a claim filed while the policy is overdue but within the grace period is generally honored by State Farm, as long as you clear the balance in full. But remember, if you're late, and have a claim and fail to pay on time, State Farm can deny coverage. This is why it is always best to pay your bills on time. Even if you are late, you are covered if you pay within the grace period, as long as the overdue amount is cleared.

If you are using the autopay system, remember that State Farm gives you time to handle any fund shortages, allowing you to delay an automatic payment for up to 15 days. And remember that your payment should match the total found in the remittance detail, which is sent to State Farm.

To get answers to your questions about accessing your State Farm bills, paying online, enrolling in autopay, and managing payment methods, remember that State Farm FAQs might have the answers you seek regarding insurance, banking, and mutual funds. Also, customer care is there to help with billing and payment FAQs.

For those using online billing and payment, note that your company entry description (example: M97) value is the last three characters of the trace number of your online file. Also, remember that State Farm's custody bank will not accept checks mailed through the post office as payment.

Before deciding on automatic payments, consider their pros and cons to see how they fit into your budget strategy. Also, State Farm isn't responsible for, nor does it endorse or approve of any information provided by external sources.

State Farm provides multiple payment options, including automatic payments, online bill pay, and payments through the mobile app. The advantage of a State Farm payment plan is that you can set it up so that your premium payment gets automatically deducted from your bank account or credit/debit card. This streamlines the payment process, and also it makes life easier by eliminating the need for checks or stamps.

| Feature | Details |

|---|---|

| Grace Period Duration | Typically around 10 days for auto insurance after the due date, but varies depending on the policy. |

| Late Fees | May be charged on overdue payments; check policy details. |

| Policy Cancellation | If payment isn't received within the grace period, State Farm may cancel the policy. |

| Claim Filing | Claims filed within the grace period are generally honored if the balance is paid in full. |

| Payment Options | Automatic payments, online bill pay, mobile app payments, and other options are available. |

| Autopay Flexibility | If funds are insufficient, State Farm may allow a delay of up to 15 days for automatic payments. |

For renters, contacting your landlord is crucial. You may be able to negotiate a payment plan, have late fees waived, or even have payments forgiven to prevent eviction. The same goes for a mortgage loan: always contact your bank or lender before you miss a payment. To avoid late payments and benefit from State Farm's grace period, make your payments on time. Also, remember that as long as you pay within the 10-day window following your bill's due date, youll maintain coverage. State Farm may also send a cancellation notice within 10 days of the bill's original due date.

Stay informed with alerts and messages by reviewing the terms and conditions for billing and payment alerts that State Farm sends to its customers via text message. Also, if you have any questions, refer to the documentation or contact customer service.

So to sum it up, State Farm gives you a bit of time to make up for a missed payment. However, to maintain coverage and avoid extra fees, its essential to stay on top of your bills.