New York State Tax Guide: What You Need To Know!

Is navigating the labyrinthine world of personal finance and tax obligations a source of constant bewilderment? Understanding New York State tax laws, rates, and regulations is not merely a civic duty; it's a crucial element in safeguarding your financial well-being, ensuring you receive every deserved deduction and credit, and avoiding costly penalties.

New York State, a vibrant hub of commerce, culture, and opportunity, also boasts a complex and often-evolving tax system. From the bustling streets of Manhattan to the serene landscapes of the Adirondacks, residents and businesses alike are subject to a variety of taxes levied by the state. These include income tax, sales tax, and various other levies designed to fund essential public services. Failure to grasp the intricacies of the New York State tax code can lead to significant financial repercussions, underscoring the importance of staying informed and proactive.

The Empire State's tax system is primarily based on the principle of progressive taxation, meaning that those with higher incomes typically pay a larger percentage of their earnings in taxes. The state's income tax rates are tiered, with different rates applying to different income brackets. Sales tax is another significant revenue source, with a statewide rate that can be supplemented by local sales taxes, varying depending on the specific county or municipality. Furthermore, property taxes play a crucial role in funding local governments and school districts, adding another layer of complexity to the overall tax landscape.

Taxpayers in New York State are required to file their state income tax returns annually, typically by the same deadline as the federal income tax deadline. The process involves gathering relevant financial documents, such as W-2 forms from employers, 1099 forms for various types of income, and receipts for any deductible expenses. Taxpayers can choose to file their returns electronically or by mail, with electronic filing generally being the more efficient and convenient option. The New York State Department of Taxation and Finance provides various resources and tools to assist taxpayers in fulfilling their obligations, including online forms, guides, and frequently asked questions.

Beyond the basic income tax, New York State offers a range of deductions and credits that can help taxpayers reduce their tax liability. These include deductions for certain expenses, such as student loan interest, alimony payments (subject to certain conditions), and contributions to retirement accounts. Tax credits, which directly reduce the amount of tax owed, are available for various purposes, such as child care expenses, college tuition, and energy-efficient home improvements. Taxpayers should carefully review these options to determine which ones they are eligible for and to ensure they are maximizing their tax savings.

The consequences of non-compliance with New York State tax laws can be severe. Penalties for failing to file a return, failing to pay taxes on time, or providing inaccurate information can include interest charges, fines, and even criminal prosecution in severe cases. Therefore, it is imperative for taxpayers to take their tax obligations seriously and to seek professional advice if they have any doubts or uncertainties. Seeking professional tax advice from a qualified accountant or tax advisor can be a wise investment, helping taxpayers navigate the complexities of the tax system, identify potential deductions and credits, and ensure compliance with all applicable laws.

Businesses operating in New York State are also subject to various tax obligations, including corporate income tax, sales tax, and payroll tax. The specific tax requirements depend on the type of business entity, its size, and its activities. Corporations are required to pay corporate income tax on their profits, while partnerships and limited liability companies may be subject to pass-through taxation, where the income is taxed at the individual partner or member level. Sales tax is collected on most goods and services sold within the state, and businesses are responsible for collecting and remitting this tax to the state. Payroll tax applies to wages paid to employees, and businesses must withhold and remit both state and federal payroll taxes.

The New York State Department of Taxation and Finance plays a crucial role in administering the state's tax system. It is responsible for collecting taxes, enforcing tax laws, and providing assistance to taxpayers. The department offers a wide range of resources to taxpayers, including online forms, publications, and customer service representatives who can answer questions and provide guidance. The department also conducts audits to ensure compliance with tax laws and to identify and address any instances of tax evasion. The department's website (www.tax.ny.gov) serves as a valuable hub for information and resources.

Tax laws are not static; they evolve over time. Changes in federal tax laws, state budget priorities, and economic conditions can all lead to modifications in the New York State tax code. It is therefore essential for taxpayers to stay informed about any legislative changes that may affect their tax obligations. The New York State Department of Taxation and Finance regularly updates its website and publishes guidance to reflect these changes. Taxpayers can also consult with tax professionals to stay abreast of the latest developments and to ensure they are making informed decisions.

The role of technology in tax filing and compliance is becoming increasingly significant. The New York State Department of Taxation and Finance has embraced technology to streamline the tax filing process and to provide taxpayers with easier access to information. Electronic filing (e-filing) is now the preferred method for most taxpayers, offering speed, accuracy, and convenience. The department also offers online account access, allowing taxpayers to view their tax records, make payments, and communicate with the department. The use of tax software and online tax preparation services has also become widespread, providing taxpayers with user-friendly tools to navigate the complexities of the tax system.

Tax planning is a proactive approach to managing your tax liabilities. It involves analyzing your financial situation and identifying strategies to minimize your tax burden legally. This may include making contributions to tax-advantaged retirement accounts, taking advantage of available deductions and credits, and investing in tax-efficient investments. Tax planning is an ongoing process that should be reviewed annually or whenever there are significant changes in your financial situation or in tax laws. Seeking advice from a qualified tax advisor can be invaluable in developing a sound tax plan tailored to your individual needs.

Here's a table summarizing key aspects of New York State Tax:

| Aspect | Details |

|---|---|

| Income Tax | Progressive tax system with graduated rates based on income brackets. |

| Sales Tax | Statewide rate, plus potential local sales taxes depending on the jurisdiction. |

| Property Tax | Significant component of local government and school district funding. |

| Filing Deadline | Typically aligns with the federal income tax deadline (usually April 15th). |

| Deductions | Student loan interest, alimony (under certain conditions), retirement contributions, and others. |

| Credits | Child care, college tuition, energy-efficient home improvements, and others. |

| Penalties | Interest, fines, and potential criminal charges for non-compliance. |

| Business Taxes | Corporate income tax, sales tax, payroll tax. |

| Department of Taxation and Finance | Administers tax system; provides resources, information, and enforcement. www.tax.ny.gov |

Many individuals find themselves questioning the nuances of the tax code, whether they are new to New York or have been residents for years. What are the specific income thresholds that determine your tax bracket? How does the state handle various types of income, from wages and salaries to investment gains and rental income? What documentation is required, and what are the options for filing your return? The complexities can feel overwhelming, and thats why understanding the core principles is so important.

New York State's income tax system operates on a progressive scale, meaning that as your income increases, the percentage of your income you pay in taxes also increases. This tiered structure features a range of brackets, each with its own applicable rate. The income thresholds that determine which bracket you fall into are adjusted periodically. These adjustments take into account factors such as inflation and economic conditions. It's crucial for taxpayers to stay informed about these changes as they can directly impact the amount of tax you owe. The New York State Department of Taxation and Finance regularly publishes updated tax brackets on its website, so thats a good place to start.

Beyond wages and salaries, the state taxes other income sources. Investment earnings, such as dividends, interest, and capital gains, are also subject to taxation. Rental income, if you own and rent out property, must be reported, with deductions permitted for related expenses like mortgage interest and property taxes. Self-employment income, if youre a freelancer or independent contractor, is subject to both income tax and self-employment tax, which covers Social Security and Medicare contributions. Understanding how to report each type of income accurately is vital to avoid underpayment or potential penalties. Consult with a tax professional or refer to the official state resources for specific guidelines on how to report various income types.

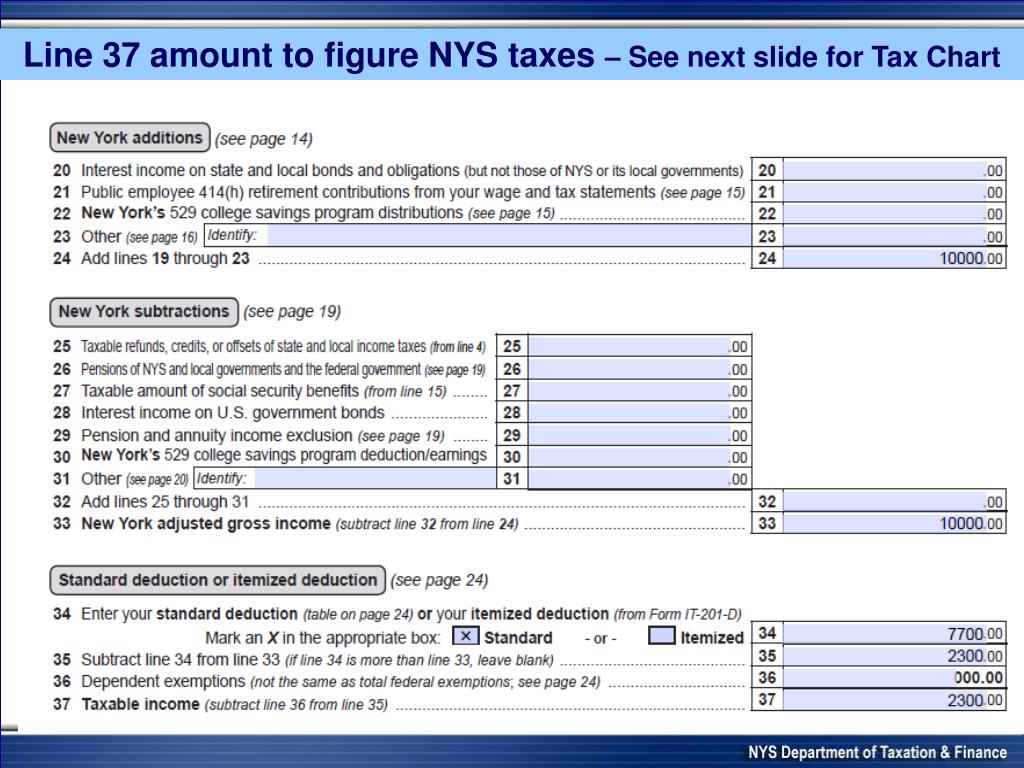

The process of filing your New York State income tax return begins with gathering all the necessary financial documents. This includes W-2 forms from your employer(s), 1099 forms for any other income you received (e.g., interest, dividends, independent contractor payments), and receipts or documentation for any potential deductions or credits you plan to claim. The state generally allows for deductions similar to the federal government, such as contributions to retirement accounts and student loan interest. There are also a variety of credits available, including those for child care expenses, college tuition, and energy-efficient home improvements. Reviewing these possibilities can help you minimize your tax liability. Ensure all the information on your return is accurate and that you retain all relevant documentation, as the state may request it for verification.

The filing deadline for New York State income tax returns typically mirrors the federal deadline, which usually falls on April 15th. However, if the deadline falls on a weekend or holiday, the due date is pushed forward to the next business day. Taxpayers can choose to file their returns electronically or by mail. Electronic filing is strongly recommended because it's generally faster, more secure, and minimizes errors. The New York State Department of Taxation and Finance offers free or low-cost electronic filing options through its website, making it easy for taxpayers to fulfill their obligations. If you choose to file by mail, make sure to use the correct forms and mail them to the appropriate address for your location, as specified in the instructions.

If you are uncertain about any aspect of your New York State tax obligations, it is highly recommended that you consult with a qualified tax professional, such as a certified public accountant (CPA) or an enrolled agent. These professionals can provide expert guidance on tax planning, compliance, and maximizing your tax savings. They can also help you navigate the complexities of the tax code and ensure that you're taking advantage of all available deductions and credits. Tax advisors can also represent you if you face an audit or have any questions related to your taxes. This investment can often pay for itself by uncovering missed deductions or minimizing your tax liability, saving you money and giving you peace of mind.

The realm of New York State taxation extends to businesses, encompassing a variety of specific tax obligations dependent on the nature of the business. Corporations operating within the state are subject to corporate income tax, which is levied on their taxable income. Businesses structured as partnerships or limited liability companies (LLCs) generally face pass-through taxation. This means that the business's income and losses are passed through to the owners or members, who then report these items on their individual income tax returns. Sales tax is a pervasive component of business taxation, as most goods and services sold within the state are subject to this tax. Businesses are responsible for collecting and remitting this sales tax to the state. Additionally, employers are responsible for withholding and remitting payroll taxes, including state and federal income taxes, as well as Social Security and Medicare taxes, from their employees' wages.

The New York State Department of Taxation and Finance serves as the primary governing body for the state's tax system. It oversees tax collection, enforces tax laws, and provides assistance to taxpayers and businesses. Their website acts as a comprehensive resource, offering downloadable forms, publications, and FAQs, along with guidance on tax-related matters. The department also conducts audits to ensure compliance and to identify and address instances of tax evasion. This multifaceted approach is central to upholding the integrity of the state's fiscal system and ensuring that all taxpayers fulfill their obligations.

Tax laws are not static; they evolve continuously. Changes at the federal level can have ripple effects that lead to adjustments in the New York State tax code. State budget priorities and the ever-changing economic landscape can also spur legislative action. As such, it's crucial for taxpayers and businesses to stay abreast of the latest developments. The New York State Department of Taxation and Finance routinely updates its website to reflect such modifications, and offers guidance on how these changes impact your tax responsibilities. Subscribing to tax-related newsletters or consulting with a tax professional is an excellent way to stay informed.

Technology continues to shape the landscape of tax filing and compliance. The New York State Department of Taxation and Finance has harnessed technology to streamline the tax process and enhance accessibility. Electronic filing (e-filing) has become the norm, affording taxpayers convenience and accuracy. Online account access allows taxpayers to manage their tax records, make payments, and communicate with the department. Tax software and online tax preparation services have expanded the options available to taxpayers, equipping them with user-friendly tools to tackle the complexities of the tax system.

Tax planning plays a critical role in responsible financial management, providing an organized approach to minimizing your tax liabilities. Proactive tax planning involves careful consideration of your financial situation and the implementation of strategies designed to legally minimize your tax burden. This might include maximizing contributions to retirement accounts, taking advantage of applicable deductions and credits, and making tax-efficient investment choices. Tax planning is a continual process that should be revisited regularly, and should be especially reviewed when significant financial or tax law changes occur. Consulting with a qualified tax advisor is a smart move for developing a tailored tax plan to suit your particular needs.