NYC Taxes: Property, Income & More - Your Guide

Are you baffled by the complexities of New York City's tax system? Understanding the nuances of property taxes, income taxes, and other levies is crucial for every resident and business in the city.

Navigating the financial landscape of New York City can often feel like traversing a labyrinth. From property taxes that fund essential city services to income taxes that impact your personal finances, a clear understanding of the rules and regulations is paramount. This article serves as a comprehensive guide, breaking down the key aspects of NYC taxes to help you navigate these financial waters with confidence.

Understanding NYC Property Taxes

Property taxes form a cornerstone of New York City's revenue generation, providing essential funding for schools, sanitation, public safety, and various other vital services. If you're a property owner in New York City, comprehending these taxes is not just beneficial, it's essential.

You can find information and services related to property taxes in New York City, which includes: rates, exemptions, abatements, bills, payments, and records. You can also explore resources for property owners and tenants through ACRIS (Automated City Register Information System), tax maps, and other resources to get detailed property information.

Accessing your property tax information is easier than ever. You can view, pay, and update your property tax bill online. The city provides several convenient methods for handling your tax obligations, ensuring accessibility for all residents.

Your property taxes are not arbitrary; they are calculated based on a variety of factors, including the assessed market value of your property and its assigned tax class. Understanding these calculations empowers you to anticipate your tax obligations accurately. Furthermore, it's important to know how your tax dollars are allocated, ensuring transparency and accountability in the city's financial processes. You can also set up notifications to stay informed about your tax bills and potential refunds.

New York City has a system of tax classes, each with its own rules. The tax class of your property determines how the city assesses its value and calculates your property tax bill. These classes are primarily determined by the propertys use. Properties are generally classified as Class 1, Class 2, Class 3, or Class 4. The most common are:

- Class 1: 1-3 family homes and condos.

- Class 2: Apartment buildings (more than 3 units) and co-ops.

- Class 4: Commercial and industrial properties.

You can search for your property information by address, BBL (Borough, Block, and Lot number), or REUC (Real Estate Unit Code) number. This access provides transparency and allows you to verify the accuracy of your property tax assessments.

NYC Income Tax

In addition to federal and state income taxes, New York City residents are also subject to a separate city income tax. This system operates independently, with its own set of rates, brackets, and rules.

The city income tax rates fluctuate from year to year, it depends on your income level and filing status. Being aware of the current rates and how they apply to your situation is vital for accurate tax planning. It's based on your New York State taxable income.

The tax rate you'll pay depends on your income level and filing status. Knowing your tax bracket and understanding the deductions and credits available to you is crucial for tax optimization. As an example, You can take a refundable credit of $125 if you're married, file a joint return, and have an income of $250,000 or less.

To estimate your tax liability, you can use online tools that help you calculate your income taxes for both New York State and New York City. These tools enable you to compare federal, state, and local tax rates, brackets, and deductions for different filing statuses and income levels.

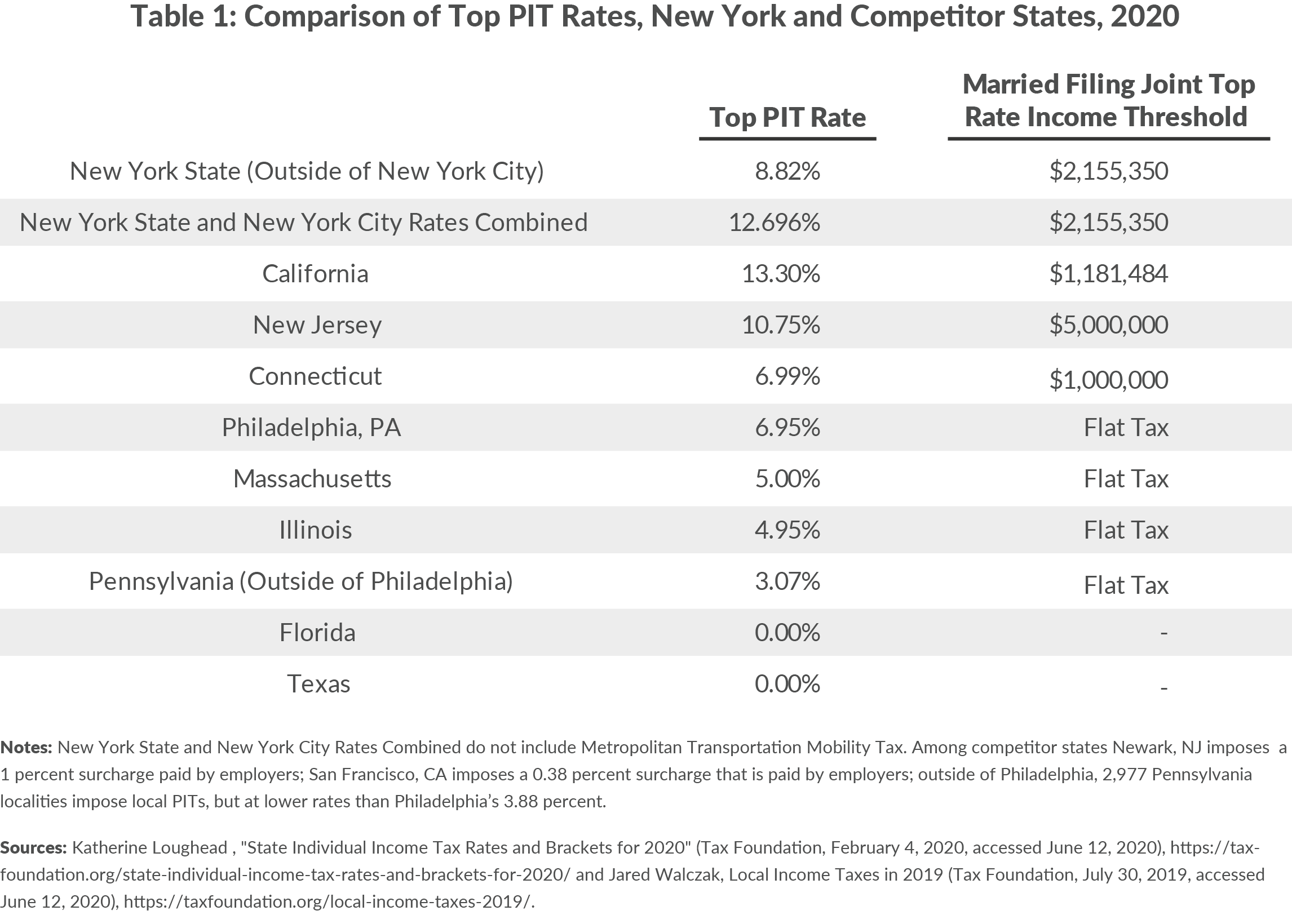

New York City imposes its own income tax in addition to state and federal taxes, with progressive rates ranging from 3.078% to 3.876%. Understanding these progressive rates means that as your income increases, the tax rate applied to that income also increases.

Staying informed about the latest developments and proposals in tax legislation is important. Understanding who is liable for NYC tax and how to plan ahead for future years is crucial. Planning is also important for 2025.

State and city tax credits often overlap, for example, taxpayers eligible for the New York State Earned Income Tax Credit (EITC) automatically receive a city.

The Department of Finance administers New York City's business and excise taxes.

NYC Income Tax for 2025: The rates are expected to change to a range between 7.078% to 10.90%.

For residents with a New York City taxable income of $500,000 or less, there is a specific credit available. The credit is a percentage of your New York City taxable income.

How to Claim the Credit: Claiming this credit often involves filling out specific tax forms and providing relevant documentation. The guidelines for claiming this credit are usually found on the New York City Department of Finance website.

New York City also has a standard deduction, which is $8,000 for single filers, and $16,050 for married filing jointly. Keep in mind the progressive nature of the New York City income tax. This tax works similarly to the federal income tax. This means the tax rate increases as your taxable income increases.

Nonresidents of New York City are not liable for New York City personal income tax.

If your primary residence, that you intend to return to after being away, is located in one of the five boroughs of New York City, it is considered your domicile.

People, trusts, and estates must pay the New York City personal income tax if they earn income in the city. This tax is collected by the New York State Department of Taxation and Finance (DTF).

Certain additional regulations apply for employees who are resident in New York City. This includes the new york city commuter tax, and potential NYC tax exemptions for commuters. Do tourists pay NYC taxes?

Business and Excise Taxes in NYC

Businesses and organizations operating in New York City are subject to various taxes. These taxes, administered by the Department of Finance, are a critical source of revenue for the city. Key examples include the Corporation Tax, Hotel Tax, and Transfer Tax.

Understanding the specifics of each tax is essential for business owners to ensure compliance and manage their financial obligations effectively.

Other Important Considerations

For those who have questions about the Metropolitan Commuter Transportation Mobility Tax (MCTMT), its calculation and applicability should be addressed. The MCTMT is a tax applied to certain businesses and individuals within the Metropolitan Commuter Transportation District. Understanding whether you are subject to this tax, along with the method for calculation, is crucial.

There are some ways to reduce or avoid paying city tax. Analyzing your tax liability and exploring potential tax-saving strategies can provide some relief. Also, it's crucial to understand how selling or renting property impacts your taxes. This information enables you to make informed decisions regarding real estate transactions and their associated tax implications.

Remember, you will not receive a bill if your taxes are paid through a bank or mortgage servicing company.

Sales Tax in NYC: The city sales tax rate is 4.5% on the service. If products are purchased, an 8.875% combined city and state tax will be charged.

Parking Tax: The city charges a 10.375% tax and an additional 8% surtax on parking, garaging, or storing motor vehicles in Manhattan.

The New York City income tax rates are 3.078%, 3.762%, 3.819% and 3.876% depending on your tax bracket and filing status. Keep in mind that NYC income tax is in addition to the state income tax that New York state charges.

Here is a table outlining key components of New York City taxes. This should give you a clear overview to begin:

| Tax Type | Description | Key Features |

|---|---|---|

| Property Tax | Tax on real estate | Rates vary, based on assessed value, tax class, and exemptions. |

| NYC Income Tax | Tax on earned income | Progressive rates, in addition to state and federal income taxes. |

| Sales Tax | Tax on goods and certain services | Combined state and city rate, varies on the service. |

| Business Taxes | Taxes on business activities | Includes corporation tax, hotel tax, and transfer tax. |

| MCTMT | Metropolitan Commuter Transportation Mobility Tax | Applies to certain businesses and individuals within the Metropolitan Commuter Transportation District. |