Get Started: CA Franchise Tax Board Services & More!

Are you ready to navigate the often-complex world of California taxes with confidence? Understanding the functionalities of the Franchise Tax Board (FTB) website is paramount for every Californian taxpayer, ensuring seamless filing, accurate payments, and easy access to vital information.

The California Franchise Tax Board (FTB) website, a vital portal for millions of Californians, offers a range of essential services designed to streamline the tax process. From filing returns and making payments to checking refunds and accessing your MyFTB account, the website serves as a one-stop shop for all your state tax needs. The site is constantly updated, with the last update occurring on January 15, 2025, showcasing its commitment to providing current and relevant information. One of the key aspects highlighted is the focus on accessibility; the FTB's website certification, dated July 1, 2023, underlines the commitment to ensuring the website is accessible to all users, regardless of their abilities. This is achieved through compliance with California Government Code sections 7405 and 11135, demonstrating the state's dedication to inclusivity. The website, part of the larger A.ca.gov network, further solidifies its role within the California government infrastructure, providing access to popular topics, online services, and crucial tax information. This ensures that taxpayers are informed, empowered, and able to meet their tax obligations with ease.

The FTB's mission is clear: to assist taxpayers in filing their tax returns accurately, on time, and to facilitate timely payments. This commitment is evident in the various services offered on the website, including the ability to file a return, make a payment, or check your refund status. Furthermore, users can conveniently access their MyFTB accounts for personalized services and tax information. Taxpayers can also navigate to the "About California" section for helpful resources and guidance. The site provides a self-serve option for entity status letters, providing a crucial service for businesses and organizations. It is important to note that changes to entity names made through the Secretary of State may take up to 30 days to be reflected within the FTBs records. This means that entity status letter requests made during this period might display the old entity name until the FTB's records are updated. The FTB also provides a tax calculator, but users should be aware that the calculator may not be suitable for all forms, specifically form 540 2EZ. Users are directed to use the 540 2EZ tax tables on the tax calculator, tables, and rates page. When accessing certain services, such as tax calculators or account access, users are required to enter their social security number and last name; the combination must match the records held to access the service. Users are instructed to enter their social security number using nine numbers, without spaces or dashes.

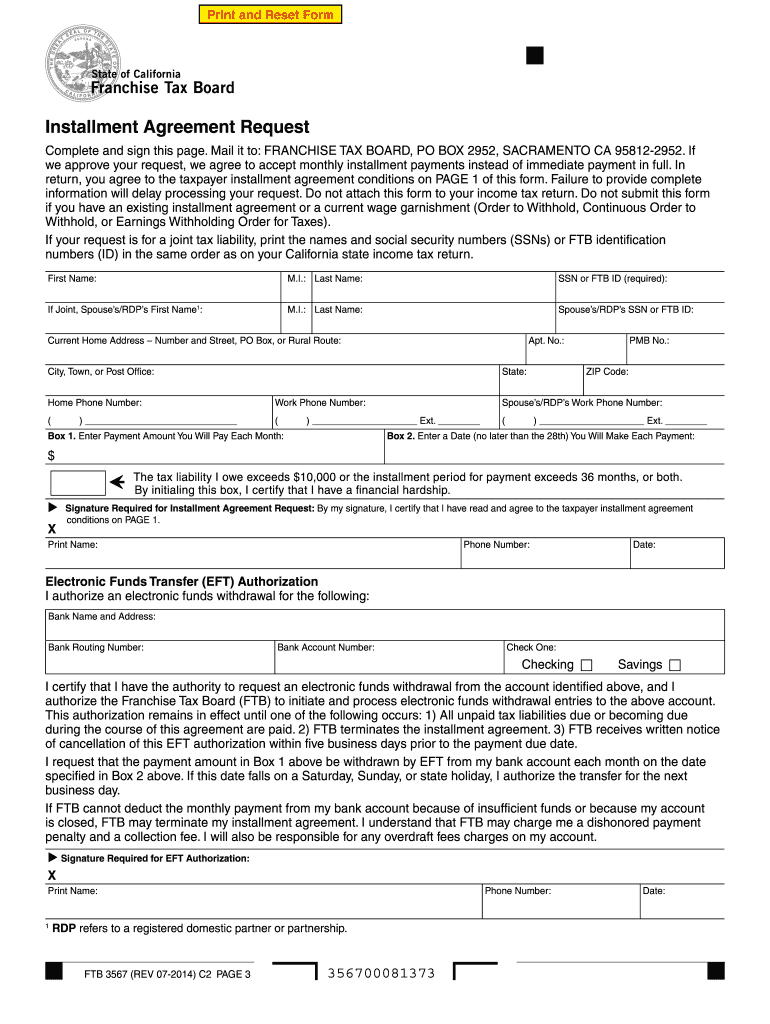

The FTB website offers several payment options to meet various preferences and needs. Taxpayers can make payments using a checking or savings account, credit card, or set up a payment plan. For those with notices, they may need to include all the numbers and the letter from the DLN field located at the top of their notice. This highlights the detailed nature of the services offered. Through careful navigation and resource utilization, taxpayers in California can streamline the tax process and remain in compliance with state laws. Accessibility is an important component of this, and the FTB is committed to providing accessible technology.

The certification from July 1, 2023 emphasizes the FTB's commitment to accessibility. The website is designed to be accessible, and compliant with California Government Code sections 7405 and 11135. This ensures that the website is accessible to all users, including those with disabilities. The FTB is committed to making its services available to all residents of California.

Here's a table summarizing key aspects of the California Franchise Tax Board and its online services, crafted for easy integration into a WordPress environment:

| Category | Details |

|---|---|

| Organization | California Franchise Tax Board (FTB) |

| Mission | To help taxpayers file tax returns timely, accurately, and pay their taxes. |

| Website Accessibility | Certified as accessible as of July 1, 2023, compliant with California Government Code sections 7405 and 11135. |

| Website URL | www.ftb.ca.gov |

| Key Services | File a return, make a payment, check your refund, access MyFTB account, access online services, self-serve entity status letter. |

| Payment Methods | Checking or savings account, credit card, payment plan. |

| Tax Calculator | Available, but does not calculate tax for Form 540 2EZ. Use 540 2EZ tax tables on the "Tax Calculator, Tables, and Rates" page. |

| Entity Name Updates | Changes made through the Secretary of State may take up to 30 days to reflect on FTB records. |

| Contact | Accessible Technology Program (contact information available on the website). |

| Website Date | Last Updated: January 15, 2025 |

| Government Affiliation | Part of the A.ca.gov website, which is part of the California government. |

In conclusion, the FTB website serves as a crucial resource for all taxpayers in California. By understanding its functionality, accessing the correct tools, and using the available resources, Californians can efficiently and accurately manage their state tax responsibilities, whether its filing a tax return, checking for refunds, or other tax-related tasks.