Drake Tax Software: Get Started Now & Boost Your Tax Season!

In the ever-evolving landscape of tax preparation, where accuracy and efficiency are paramount, could a software solution truly streamline your workflow, enhance client satisfaction, and ultimately boost your bottom line?

The tax preparation industry, a field demanding precision and adaptability, has witnessed a transformative shift in recent years. The complexities of tax codes, the relentless changes in regulations, and the need for secure data management have placed significant demands on tax professionals. However, amidst this evolution, a suite of tools has emerged, promising to navigate these challenges: Drake Tax Software.

Drake Tax Software has earned a commendable position in the professional tax preparation arena for several years. Established in 1977 and headquartered in Franklin, North Carolina, the company has consistently strived to provide the tools and support that tax professionals require to build their businesses and attract new clients. The softwares reputation is built on its commitment to customer service, affordability, and reliability. Users are not merely adopting software; they are entering a partnership with a dedicated team. As John Weitz aptly stated on August 24, 2023, the "support and software engineers make my job as a tax preparer much easier and provide the tools needed to have a successful tax season."

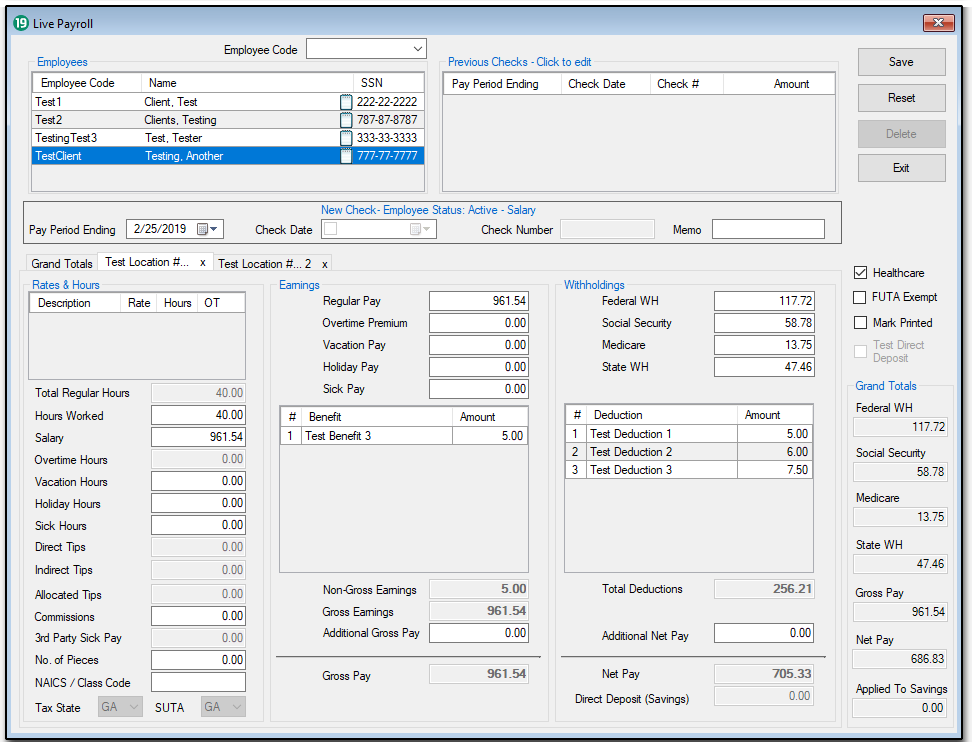

Let's delve deeper into the specifics of Drake Tax Software, its features, and the impact it can have on a tax professional's practice. The platform itself is designed to be a professional tax preparation software, equipped with integrations for accounting, document management, and payment processing. This suite of capabilities allows tax preparers to move seamlessly from data entry to filing, archiving documents, and managing client communications all within one system.

One notable aspect of Drake Tax Software is its versatility. Tax professionals can prepare a wide array of forms, including 1040, 1065, 1120, 1041, 990, and 709, which caters to a diverse clientele and allows a practice to extend its services. The software's availability in different editions allows the user to select the edition which is perfect fit for their requirements, Drake accounting is also available with the forms edition which is designed for direct data entry. The platform is available in two editions: Forms Edition and Professional Edition. This model caters to the unique needs of different-sized firms and their individual approaches to tax preparation. The Forms Edition is available for $395, giving an affordable option to entry-level users.

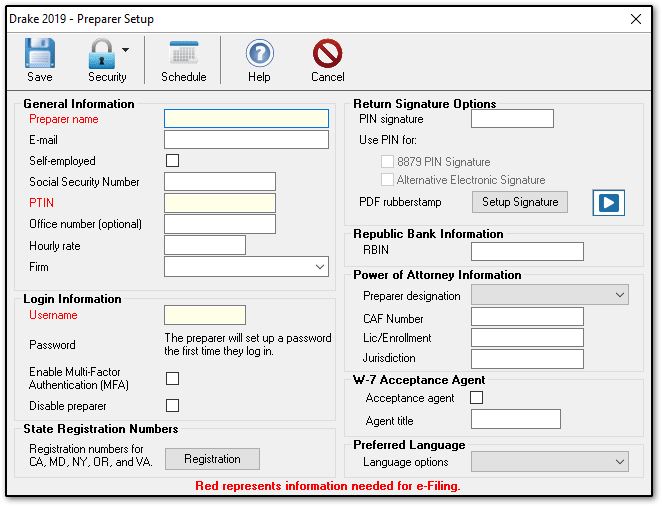

For those interested in exploring the software, Drake offers a free trial. Potential users can "Try it free, watch demos, view webinars, and learn about Drake's products, pricing, and service and support." This approach allows tax professionals to get familiar with the platform and the functions that are perfect for them. They are offered a glimpse into its capabilities before committing to a paid subscription. Furthermore, Drake provides instructional videos covering the basics of the software, which can be especially helpful for new users or those transitioning from another system. Content with closed caption [CC] enabled is available by clicking [CC] in the video or its summary.

The software's user-friendly design extends to the renewal process. "You can renew the software online, using a credit or debit card, by completing the following steps: Log in to the Drake software support website. On the left, choose account > renewals." This streamlining of the payment process ensures that tax professionals can continue using the software seamlessly without interruption.

Drake Tax Software is a comprehensive solution, as emphasized by its comprehensive support system. Regular updates and new features keep users ahead of industry standards. These updates can be reviewed for a smooth transition to current software versions. The software undergoes changes throughout the year, with improvements that are dedicated to improving user experience. Drake documents, a virtual filing cabinet providing return archiving and source document storage, is included free with the software.

The single-user versions of Drake Tax Pro and Drake Tax 1040 are specifically designed for businesses with a single tax return preparer (PTIN holder). Anyone with a PTIN who prepares or substantially aids in preparing tax returns is considered a tax preparer and, therefore, is counted as a user. These features help to maintain the structure and integrity of the user profiles.

A key component of Drake's service is Protection Plus, which provides audit assistance and identity theft assistance to clients. This offers added value to the services offered, and peace of mind. As a tax professional, providing Protection Plus has many benefits. It can potentially increase the value of your services and foster a stronger relationship with your clients. Moreover, Drake offers various resources such as live sales webinars on Tuesdays, providing insights on customizing, navigating, and electronic filing with Drake Tax. On Thursdays, the sales team presents special topics on key tax industry issues and solutions from Drake software experts and industry partners. These webinars help with knowledge and skill advancement.

Drake Tax Software provides advantages in several key areas: User-Friendly Interface, Comprehensive Form Support, Integration Capabilities, Affordability, Strong Customer Support, and Commitment to Innovation.

There are, of course, some limitations to consider. While Drake provides extensive support and integrations, the overall effectiveness of the platform depends on the user's proficiency and their business requirements. Also, the software may not be a perfect fit for every tax practice, and users should consider a demo before opting in.

In conclusion, Drake Tax Software positions itself as a complete solution for tax professionals, offering a combination of features, benefits, and resources designed to streamline tax preparation, improve client relationships, and empower businesses. By considering both the advantages and the potential limitations, and by utilizing the provided resources like demos and webinars, tax professionals can determine if Drake Tax Software is the right solution for their practice.

One of the best things about Drake is the feedback from the customers, here are some of the reviews from different tax professionals:

"I'm so grateful for finding Drake Tax Software and switching over to them 7 years ago! Their pricing is very reasonable, and their customer support is outstanding!"

Good people and a strong support team, that's why I use Drake software.

This software is a professional tax preparation software with integrations for accounting, document management, and payment processing.

To delve deeper into Drake Tax Software, explore its features, and understand its transformative potential, consider these steps:

- Visit the Drake Software website to explore products, pricing, and support.

- Try the software for free and watch demos.

- Attend live sales webinars and view instructional videos to learn the software's functions and features.

- Explore the software, and its integration with accounting, document management, and payment processing.

- Consider protection plus to ensure more value to your services.

| Feature | Description | Benefits |

|---|---|---|

| Comprehensive Form Support | Supports a wide array of tax forms including 1040, 1065, 1120, 1041, 990, 709, and more. | Allows tax professionals to cater to a diverse client base and offer a wider range of services. |

| Integration Capabilities | Integrates with accounting, document management, and payment processing systems. | Streamlines workflows, reduces manual data entry, and improves overall efficiency. |

| User-Friendly Interface | Designed for ease of use, with features that aid navigation. | Reduces the learning curve and allows tax professionals to quickly adapt to the software. |

| Affordability | Offers competitive pricing, including a Forms Edition for direct data entry at $395. | Makes professional tax preparation software accessible to a wider range of users, including those with limited budgets. |

| Customer Support | Provides outstanding customer support, including webinars and a team of experts. | Ensures users can quickly resolve any issues and maximize their productivity. |

| Innovation | Drake Software consistently implements updates and new features. | Keeps users abreast of the latest industry changes and ensures software relevance. |

| Drake Documents | A virtual filing cabinet that provides return archiving and source document storage. | Helps the user to archive and store the important documents. |

| Protection Plus | Offers audit assistance and identity theft assistance for clients. | Increases the value of tax preparation services, enhances client loyalty, and provides peace of mind. |

As the landscape of tax preparation continues to evolve, Drake Tax Software stands out as a dynamic platform that offers comprehensive resources, reliable support, and valuable integrations, enabling tax professionals to serve their clients efficiently.

For those looking to enhance their tax preparation practice, Drake Tax Software's approach providing comprehensive tools, offering continuous support, and encouraging innovation has become one of the prominent solutions in the industry. The platform encourages tax professionals to be successful and make a difference in their field.