California FTB Guide: File, Pay, & More - Your Tax Resources

Are you ready to navigate the often-turbulent waters of California taxes? Understanding the California Franchise Tax Board (FTB) is crucial for every individual and business operating within the Golden State.

The FTB, a pivotal agency within the California government, holds significant influence over your financial interactions with the state. From personal income tax to corporate franchise and income tax, the FTB is the primary collector and administrator. This comprehensive overview aims to demystify the FTB, providing you with essential insights to successfully fulfill your tax obligations.

| Aspect | Details |

|---|---|

| Agency Name | California Franchise Tax Board (FTB) |

| Primary Function | Administers and collects state personal income tax and corporate franchise and income tax in California. |

| Governing Body | Composed of the California State Controller, the Director of the California Department of Finance, and the Chair of the California State Board of Equalization. |

| Parent Agency | California Government Operations Agency |

| Headquarters | Sacramento, California |

| Website Accessibility Certification | As of July 1, 2023, the FTB's website is certified as accessible, complying with California Government Code Sections 7405 and 11135. |

| Online Services | Offers online services to file returns, make payments, and check refund status through the "MyFTB" account. |

| Minimum Franchise Tax (Corporations) | $800 (or a percentage of net income, whichever is greater). |

| Payment Methods | Online, by mail, or in person at FTB field offices. |

| Penalties for Non-Payment | Penalties apply for late tax payments, including a 5% underpayment penalty plus an additional 0.5% per month until paid. |

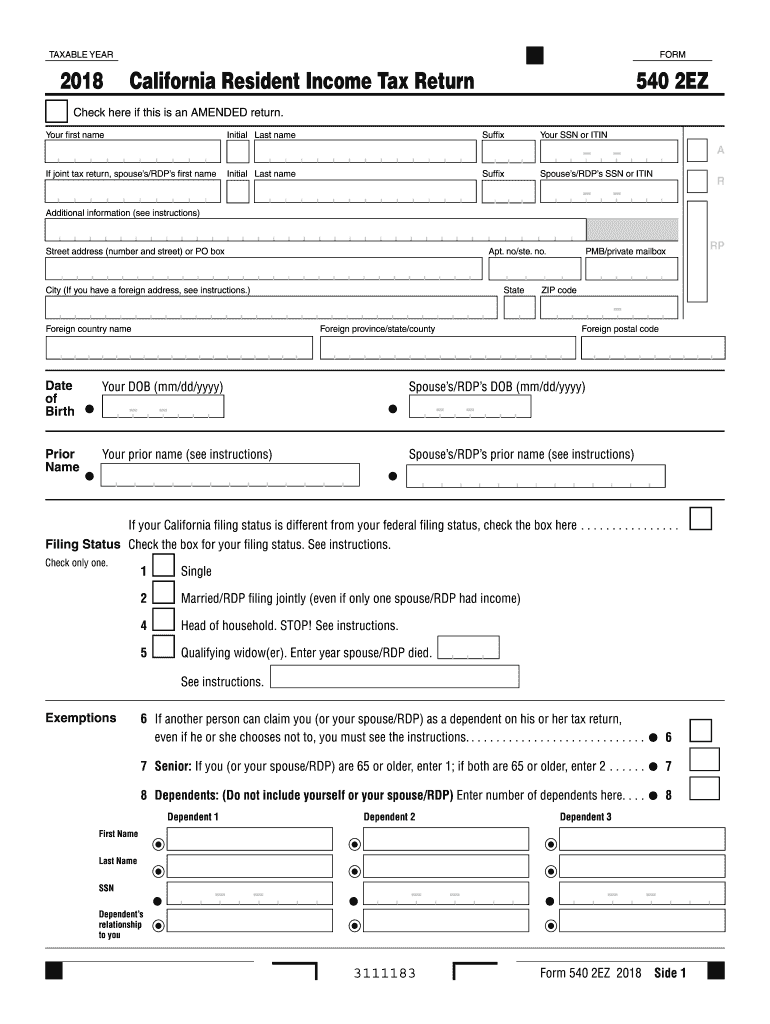

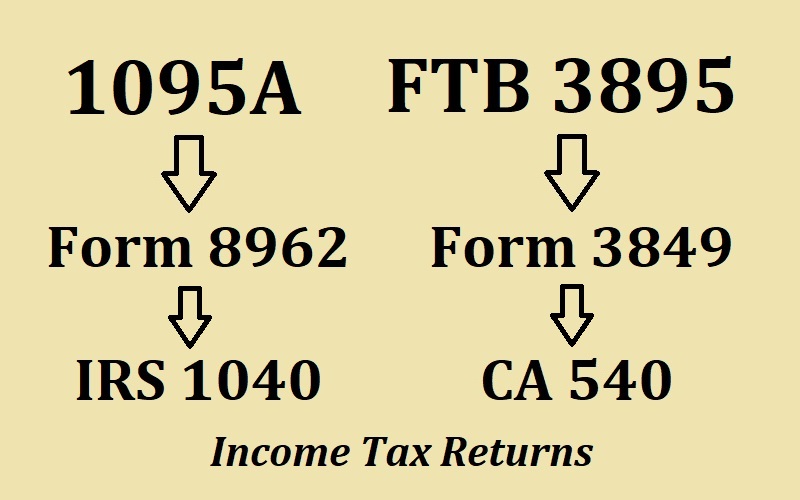

| Relevant Forms | Includes form 540 (personal income tax), form 568 (for LLCs), FTB 3531 (credit instructions), and FTB 3519 (payment for automatic extension), and FTB 3895 (California Health Insurance Marketplace Statement). |

| Important Note | The FTB is not related to franchised businesses and taxes; it is a state tax collector. |

| Last Updated | 01/15/2025 |

| Website Link | California Franchise Tax Board Official Website |

The FTB's reach is extensive, touching nearly every Californian who earns income. Understanding its structure and operations is vital for both individual taxpayers and businesses. The FTB is a department within the California Government Operations Agency, and its leadership comprises key state officials, ensuring its alignment with state financial policies. Specifically, the board consists of the California State Controller, the Director of the California Department of Finance, and the Chair of the California State Board of Equalization. This composition reflects the importance of the FTB in managing the state's revenue streams.

The FTB is responsible for administering and collecting a range of taxes, most notably state personal income tax, corporation tax, and franchise tax. It also handles the collection and distribution of property taxes, further solidifying its central role in state finances. Beyond tax collection, the FTB provides crucial customer service and support to taxpayers, offering resources and guidance to navigate the complexities of the California tax system. This support encompasses various channels, from online resources to physical offices located throughout the state, ensuring that taxpayers have the assistance they need.

The process of interacting with the FTB often begins online. The agency's website serves as a central hub for various services, including filing returns, making payments, and checking the status of tax refunds. Taxpayers can log in to their "MyFTB" accounts to manage their tax affairs. The website is designed to be user-friendly, providing links to popular topics and online services. The FTB also prioritizes accessibility; as of July 1, 2023, the website is certified to be accessible, aligning with California Government Code sections 7405 and 11135. This accessibility ensures that all taxpayers, including those with disabilities, can easily access the necessary information and services.

Corporations operating in California face specific obligations. The minimum franchise tax for corporations is $800. However, the actual tax liability might be higher, depending on the corporation's net income. If the corporation's net income multiplied by its applicable corporate tax rate exceeds $800, the higher amount must be paid. Corporations can pay their taxes online, by mail, or in person at California Franchise Tax Board field offices, providing flexibility in how they fulfill their tax obligations. The FTB is responsible for collecting this tax within California's geographical boundaries.

Its crucial to understand that the "franchise tax" collected by the FTB is not related to the common understanding of franchises (like fast-food restaurants or retail chains). Instead, it is a state tax levied on businesses registered within California. This tax is similar to those collected by other states in the US from businesses operating within their borders. The FTB does provide tools, such as a refund status tool on its website, to allow taxpayers to track their tax refunds. Accessing this tool often requires providing specific information, helping taxpayers stay informed about their tax returns.

Failure to meet tax obligations can result in penalties. The FTB imposes penalties for not paying taxes by the due date. A 5% underpayment penalty is applied if you owe less than $1,000 in tax, but there's an additional 0.5 percent added each month it remains unpaid. These penalties underscore the importance of timely tax payments to avoid added financial burdens.

For businesses structured as LLCs, specific instructions are essential when paying taxes. Payments are typically made by check or money order, using black or blue ink, payable to the Franchise Tax Board. Crucially, the LLC's California SOS file number, FEIN (Federal Employer Identification Number), and the tax years form (e.g., 2024 Form 568) must be included on the payment instrument. This detailed approach ensures correct processing and crediting of payments.

Taxpayers can find valuable instructions related to various credits, such as instructions for Form FTB 3531, Part III, for specific tax credits. For those with higher incomes, the tax calculation method changes. If your taxable income on form 540, line 19, exceeds $100,000, you will use specified methods; otherwise, you can use the tax table provided. This tiered system recognizes that tax obligations differ by income level.

The FTB offers numerous resources, including various forms and publications, to help taxpayers. Notable among these are form FTB 3895 (California Health Insurance Marketplace Statement) and FTB publications. These resources are designed to guide taxpayers through the various aspects of the California tax system and to help them meet their responsibilities accurately. If a dependent files a tax return, only that dependent or the individual responsible can claim certain credits or benefits. This ensures that the correct person receives any benefits offered by the state.

The FTBs commitment to accessibility, as highlighted by the July 1, 2023, certification date, demonstrates its dedication to ensuring that all taxpayers have equal access to its services. This commitment extends to both online and offline resources, making it easier for everyone to manage their tax obligations. The FTBs consistent efforts to modernize its processes and maintain a user-friendly interface reflect its goal to support taxpayers effectively.

Whether you are an individual taxpayer, a small business owner, or part of a large corporation, interacting with the FTB is unavoidable if you are paying taxes in California. Understanding the FTB's responsibilities, the services it provides, and the penalties associated with non-compliance is crucial to successfully navigating the California tax landscape. By utilizing the resources available and staying informed, you can meet your tax obligations confidently and avoid potential pitfalls.